Let's Master AI Together!

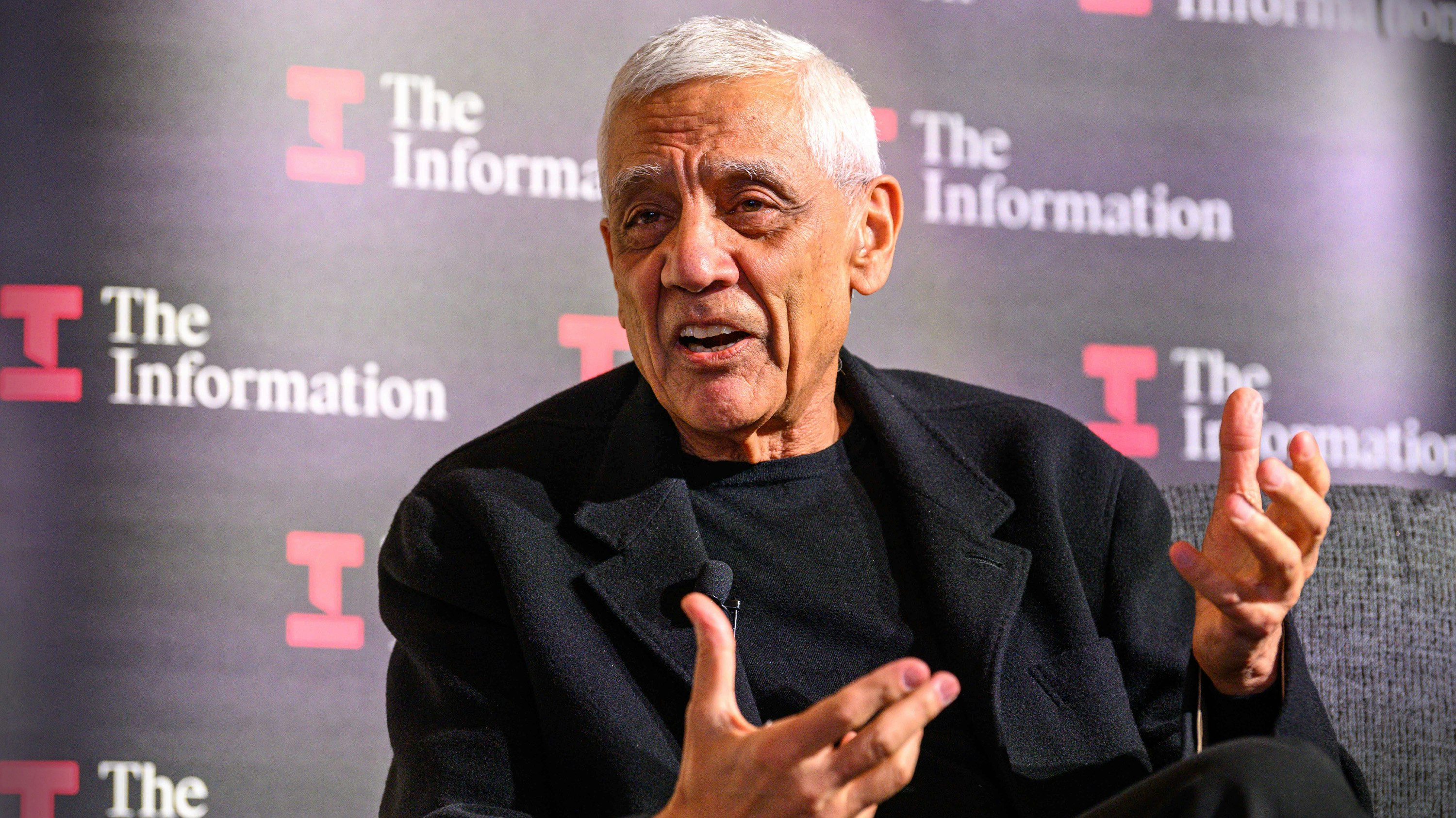

Vinod Khosla's Cautionary Insights on AI Investments During Greed Cycle

Written by: Chris Porter / AIwithChris

Image source: Tii

The Landscape of AI Investments

Venture capital in the realm of artificial intelligence (AI) has been characterized by astonishing growth and, increasingly, a sense of urgency amongst investors. High-profile figures, such as Vinod Khosla, an influential venture capitalist and an early supporter of OpenAI, have started to take a cautious stance. Khosla’s recent assertions spotlight a critical issue within the AI investment landscape: the risk of a 'greed' cycle, which he believes could lead to significant financial losses for many investors.

Khosla's concerns stem from the observation that a range of investors, buoyed by the momentum of successful AI applications, are rushing to back any venture associated with this technology. This rush is often propelled by market euphoria rather than a solid understanding of the underlying business models or technologies. With numerous experts predicting substantial growth in AI, the market has become saturated with ventures that may not have robust fundamentals, leading to Khosla’s skepticism about future returns.

Identifying the core issue, Khosla articulates that the current wave of AI investments seems to lack a discerning focus. Instead of rooting for sustainable and substantial innovations, the trend has shifted towards short-term gains, mirroring past bubbles in technology and finance. By diving into projects with inflated valuations, investors may be overlooking potential pitfalls, driving the market closer to a downturn.

Khosla's Shift in Investment Strategy

Known for his foresight in the tech industry, Vinod Khosla is adapting by navigating his investment strategy away from mainstream AI startups that have recently enjoyed inflated valuations. Khosla asserts that a more prudent approach would involve investing in less glamorous but fundamentally sound sectors, such as mineral exploration and developing sustainable technologies in lithium, cobalt, and aerospace efficiency. This pivot reflects his underlying belief that the AI market, while promising, is currently more about hype rather than substance.

His strategy seeks to leverage opportunities in industries that lie outside of the AI spotlight but possess immense potential for growth. For instance, lithium and cobalt are critical components in the production of batteries for electric vehicles—a market that is set to expand exponentially as demand for sustainable transportation increases. By prioritizing these sectors, Khosla highlights the importance of looking at long-term trends rather than being swayed by the AI gold rush.

Moreover, the aerospace sector, known for its rigorous safety and efficiency demands, offers avenues for technological advancements that Khosla finds viable. By honing in on these areas, he believes he can mitigate risks associated with the current wave of AI exuberance while securing long-term financial stability.

The Emotional Nature of Market Behavior

Khosla’s critique of the AI investment frenzy is underpinned by his observations regarding human behavior in financial markets. He suggests that investors often allow emotions to dictate their decisions, swinging between fear and greed. This psychological phenomenon can lead to irrational investment choices that undermine investment returns. The current inclination towards AI appears to be a manifestation of greed, compelling investors to overlook sound judgment.

In creating a cautionary narrative, Khosla echoes sentiments that align with investment principles advocating for rational decision-making. His advocacy for a level-headed approach serves as a reminder not only for investors but also for tech entrepreneurs crafting AI solutions that address genuine problems instead of jumping on the hype bandwagon.

By advocating for an analytical perspective and encouraging independent thinking, Khosla aims to steer clear of impulsive market trends. His reflections urge investors to take a step back and evaluate whether their participation in AI investments is driven by reasoned analysis or merely a reaction to market buzz.

OpenAI: An Outlier in Khosla's Perspective

Despite his skepticism about the broader AI investment landscape, Khosla maintains a notably positive outlook on OpenAI. Celebrated for its innovative approach to artificial intelligence, OpenAI continues to attract significant attention and reportedly engage in discussions about noteworthy valuation increases. Khosla’s early investment in the organization speaks volumes about his ability to identify promising ventures amidst a turbulent marketplace. His confidence in OpenAI suggests that he recognizes the company’s solid foundational work is built on substantial research, commitment to ethics, and groundbreaking technology, distinguishing it from many other companies.

What sets OpenAI apart in Khosla's view is its capacity to continually innovate while adhering to ethical considerations in AI development. This balanced approach resonates deeply with Khosla, who understands the necessity of aligning technology with genuine advancements rather than mere financial speculation.

As one of the limited number of firms that command the trust of experienced investors like Khosla, OpenAI stands out for its attempts to leverage AI responsibly. Such differentiators might set the course for sustainable success and create a model of how technology companies should navigate the turbulent waters of investment hype.

Lessons from Khosla's Insights

The implications of Khosla's views extend beyond personal investment choices; they hold far-reaching lessons for the broader investment community and budding entrepreneurs in the AI space. His thoughts underscore the necessity for due diligence, emphasizing that solid business models, comprehensive market analysis, and a focus on sustainability should guide investment decisions.

For entrepreneurs aspiring to launch AI-focused startups, Khosla is a reminder of the importance of building a business grounded in solving real-world challenges. It's critical to attract investors with a clear value proposition and a business strategy that is not solely reliant on market fads.

As the tech landscape continues to shift, the ability to discern between genuine innovation and fleeting trends has never been more important. Cautionary tales from the likes of Khosla serve to remind entrepreneurs and investors alike that understanding market dynamics and maintaining perspective is essential in the quest for sustainable growth.

The Future of AI Investments

Moving forward, the AI investment landscape remains dynamic and uncertain. While Khosla's sentiments reflect a necessary caution, it's also vital to recognize the potential for transformative advancements in the sector. For some, there may be an opportunity to identify under-the-radar technologies that could lead to robust returns over time.

Finding the balance between excitement and circumspection is the key to navigating this space. Investors would benefit from embracing a mindset focused on long-term success rather than immediate gains, evaluating innovative AI companies with scalability and strong leadership.

In conclusion, the AI landscape requires a critical perspective reflective of Khosla's insights. Advancements will continue to emerge, and for those ready to look beyond the present market frenzy, the opportunities to drive genuine innovation and value can lead to fruitful ventures. The next chapter in AI's evolution could very well depend upon discerning which opportunities to pursue sustainably.

For more information on artificial intelligence developments, strategies, and insights, visit AIwithChris.com.

_edited.png)

🔥 Ready to dive into AI and automation? Start learning today at AIwithChris.com! 🚀Join my community for FREE and get access to exclusive AI tools and learning modules – let's unlock the power of AI together!